In the ever-evolving landscape of the stock market, staying ahead of trends is crucial for investors. Large cap stocks, known for their stability and market influence, have always been a cornerstone of investment portfolios. This article delves into the momentum analysis of US large cap stocks, offering insights into their recent performance.

Understanding Large Cap Stocks

Large cap stocks refer to shares of companies with a market capitalization of over $10 billion. These companies are typically well-established, with a strong presence in the market. They are often seen as a barometer for the overall health of the economy due to their significant market influence.

Momentum Analysis: What It Means

Momentum analysis is a method used to identify stocks that are currently on the rise. It involves examining the rate of change in a stock's price and volume. The idea is that stocks with strong momentum are likely to continue their upward trend.

Recent Performance of US Large Cap Stocks

The recent performance of US large cap stocks has been quite impressive. Here are some key insights:

- Growth in Market Capitalization: The total market capitalization of US large cap stocks has been on the rise, indicating a strong investor sentiment.

- Positive Earnings Reports: Many large cap companies have reported robust earnings, contributing to their upward momentum.

- Dividend Yields: Large cap stocks have continued to offer attractive dividend yields, making them a favorite among income-seeking investors.

Case Studies

To illustrate the recent performance of US large cap stocks, let's look at a couple of case studies:

- Apple Inc. (AAPL): Apple has been a major driver of the tech sector's growth. Its recent earnings report showed strong revenue and profit growth, contributing to its upward momentum.

- Exxon Mobil Corporation (XOM): As one of the largest oil and gas companies in the world, Exxon Mobil has been resilient in the face of market volatility. Its recent performance has been strong, driven by increasing oil prices.

Factors Influencing Large Cap Stock Performance

Several factors have influenced the recent performance of US large cap stocks:

- Economic Growth: Strong economic growth has been a key driver of large cap stock performance.

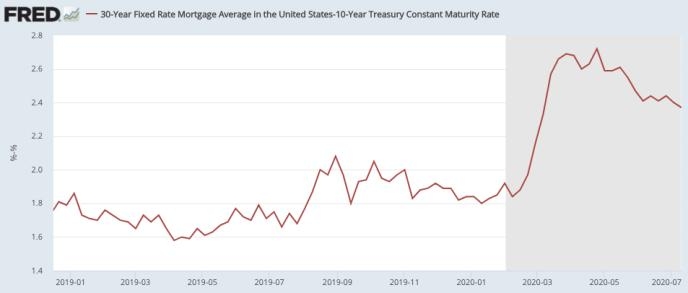

- Low Interest Rates: Low interest rates have made investing in stocks more attractive, pushing investors towards large cap stocks.

- Globalization: The increasing interconnectedness of the global economy has opened up new opportunities for large cap companies.

Conclusion

The recent performance of US large cap stocks has been impressive, driven by factors such as economic growth, low interest rates, and globalization. However, it's important to conduct thorough research and consider market risks before investing in these stocks. By understanding the momentum and factors influencing large cap stocks, investors can make informed decisions and potentially benefit from their upward trends.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....