In the ever-evolving world of finance, keeping up with the latest stock market trends is crucial for investors. One term that has gained significant attention is "US New Stock." This article delves into what it means, how to identify these stocks, and why they might be a valuable addition to your investment portfolio.

Understanding "US New Stock"

"US New Stock" refers to newly listed companies on American stock exchanges. These companies are often in the early stages of their growth cycle, presenting investors with the opportunity to capitalize on their potential for significant returns. It's important to note that while these stocks can offer substantial upside, they also come with higher risk due to their nascent stage.

Identifying US New Stocks

To identify US New Stocks, investors should keep an eye on the following:

- Initial Public Offerings (IPOs): These are the first-time offerings of stock to the public. Companies like Uber and Airbnb have made headlines with their IPOs.

- Direct Public Offerings (DPOs): Similar to IPOs, but without the need for underwriting. This method allows companies to raise capital directly from investors.

- Oversubscribed Stocks: These are stocks that receive more investor interest than the available shares. This can be a sign of a highly sought-after company.

Why Invest in US New Stocks?

Investing in US New Stocks offers several advantages:

- Potential for High Returns: As these companies are in their early stages, they have the potential for rapid growth, leading to significant returns.

- Market Trends: Investing in US New Stocks allows you to stay ahead of market trends and capitalize on emerging industries.

- Diversification: Adding US New Stocks to your portfolio can help diversify your investments, reducing risk.

Case Studies: Successful US New Stocks

Several companies have made a name for themselves by going public as US New Stocks. Here are a few notable examples:

- Facebook (now Meta Platforms, Inc.): Launched in 2004, Facebook went public in 2012. Since then, it has become one of the world's largest social media platforms.

- Tesla, Inc.: Founded in 2003, Tesla went public in 2010. It has since revolutionized the electric vehicle industry and become a leader in sustainable energy solutions.

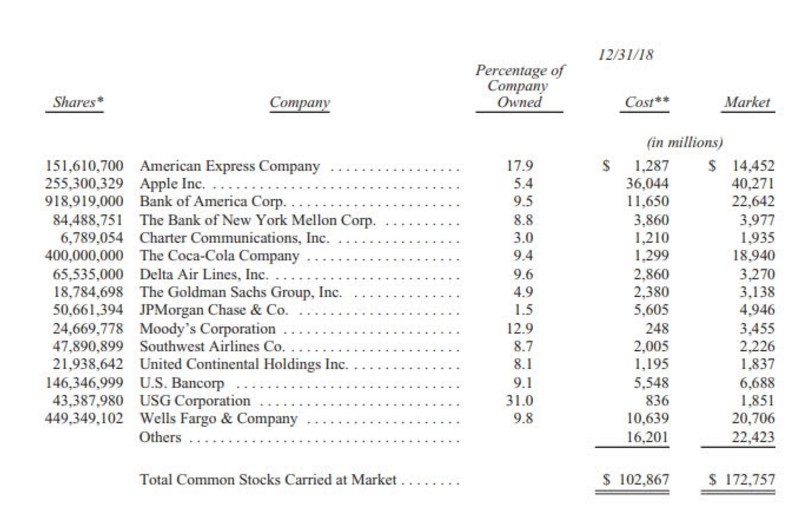

- Berkshire Hathaway: While not a traditional US New Stock, Warren Buffett's company went public in 1962. It has since become one of the most successful and well-known investment companies in the world.

Conclusion

Investing in US New Stocks can be a lucrative opportunity for investors willing to take on the risk. By understanding what these stocks are, how to identify them, and the potential benefits they offer, investors can make informed decisions and potentially capitalize on significant returns. Always remember to do thorough research and consult with a financial advisor before making any investment decisions.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....