The COVID-19 pandemic has undoubtedly caused a global economic downturn, but it has also sparked a wave of recovery across various industries. As the world slowly reopens, investors are on the lookout for "recovery stocks US" that can capitalize on the post-pandemic boom. This article will delve into the concept of recovery stocks, highlight some of the best picks in the US market, and provide insights into how to identify these opportunities.

Understanding Recovery Stocks

Recovery stocks are shares of companies that are poised to benefit significantly from the economic recovery following a downturn. These stocks often belong to companies that have been hit hard by the crisis but have the potential to bounce back stronger than before. Recovery stocks can be found in various sectors, including technology, healthcare, consumer goods, and finance.

Key Characteristics of Recovery Stocks

- Resilience: These companies have demonstrated their ability to survive during tough times.

- Relevance: Their products or services are in high demand as the economy recovers.

- Growth Potential: They have the potential to grow significantly as the market recovers.

Top Recovery Stocks in the US

1. Technology

Technology has been one of the most resilient sectors during the pandemic. As more people shifted to remote work and online shopping, tech companies saw a surge in demand for their products and services.

- Amazon (AMZN): The e-commerce giant has seen a massive increase in sales as people shop online more than ever.

- Microsoft (MSFT): The software giant has seen a surge in demand for its cloud services and productivity tools.

2. Healthcare

The pandemic has underscored the importance of healthcare, and several healthcare companies have emerged as strong recovery stocks.

- Moderna (MRNA): The biotech company's COVID-19 vaccine has been a game-changer, and its shares have soared as a result.

- Regeneron (REGN): The biotech firm has developed a successful COVID-19 antibody cocktail, and its shares have followed suit.

3. Consumer Goods

Consumer goods companies that offer essential products have seen a significant boost in sales during the pandemic.

- Procter & Gamble (PG): The consumer goods giant has seen increased demand for its hygiene products.

- Coca-Cola (KO): The beverage company has seen strong sales, particularly in emerging markets.

4. Finance

The finance sector has also seen some interesting recovery stocks, particularly those focused on digital banking and fintech.

- SoFi (SOFI): The fintech company has seen a surge in demand for its personal loans and banking services.

- PayPal (PYPL): The digital payments company has seen increased usage as more people shop online.

Identifying Recovery Stocks

When searching for recovery stocks, it's essential to look for companies with a strong track record, a clear growth strategy, and a solid financial position. Additionally, consider the following factors:

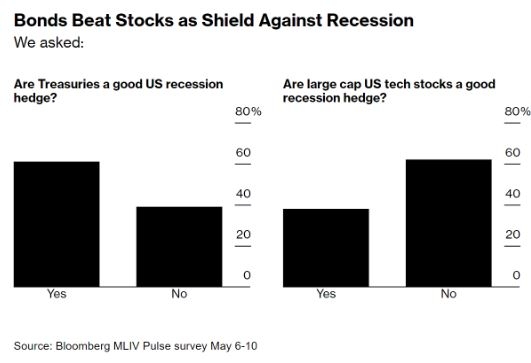

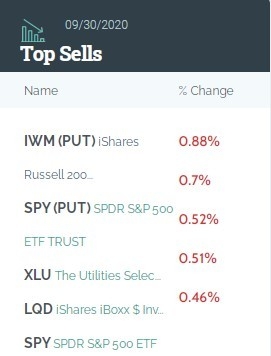

- Market Trends: Look for sectors that are poised to benefit from the post-pandemic recovery.

- Company Financials: Analyze the company's financial statements to ensure it has the resources to recover.

- Management Team: A strong management team can make a significant difference in a company's recovery.

Conclusion

Investing in recovery stocks US can be a smart strategy for capturing the post-pandemic boom. By understanding the characteristics of these stocks and conducting thorough research, investors can identify promising opportunities in various sectors. Remember to diversify your portfolio and consult with a financial advisor before making any investment decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....