In today's globalized economy, tariffs play a significant role in shaping market dynamics, particularly in the US stock market. As the world's largest economy, the US stock market is often considered a bellwether for global financial health. This article delves into the impact of tariffs on the US stock market, analyzing the implications for investors and businesses.

Understanding Tariffs

Tariffs are taxes imposed on imported goods and services. They are used to protect domestic industries, raise revenue, or both. In recent years, tariffs have become a contentious issue, particularly between the US and China. The trade tensions have led to a series of tariffs on goods ranging from steel and aluminum to consumer electronics.

Impact of Tariffs on the US Stock Market

The US stock market has been sensitive to the tariff situation. Here's how:

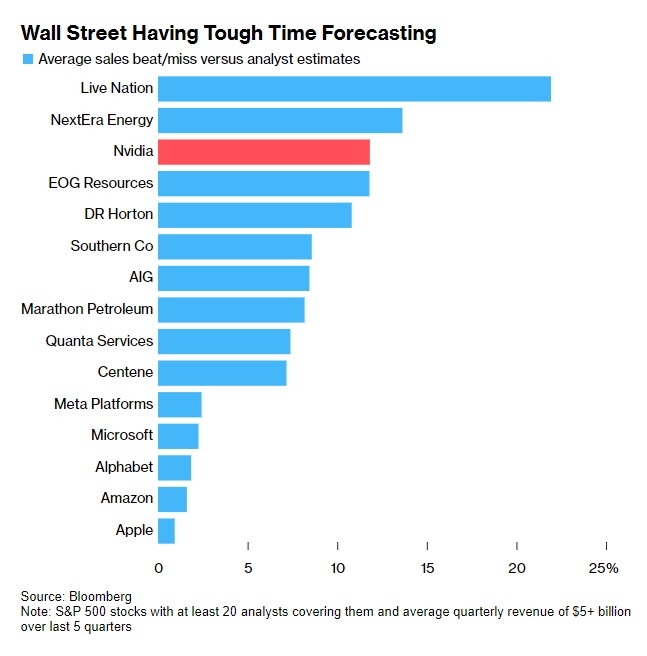

Company Profits: Tariffs can increase the cost of imported goods, thereby affecting the profitability of companies that rely on these imports. This has been particularly evident in industries such as technology, automotive, and consumer goods.

Investor Sentiment: The uncertainty surrounding tariffs has led to increased volatility in the stock market. Investors are often wary of companies exposed to tariffs, leading to a sell-off in their stocks.

Global Supply Chains: The US stock market is interconnected with global supply chains. Tariffs can disrupt these chains, leading to increased costs and reduced efficiency for companies.

Currency Fluctuations: Tariffs can impact currency values, which in turn affect the value of stocks. A weaker dollar, for instance, can make US exports more competitive but also make imports more expensive.

Case Studies

Tesla: As a company heavily reliant on imported batteries and other components, Tesla has been negatively impacted by tariffs. The company has warned that tariffs could lead to increased costs and reduced profitability.

Apple: Apple, another technology giant, has also expressed concerns about the impact of tariffs on its supply chain. The company has been working to diversify its supply chain to mitigate the risks associated with tariffs.

Conclusion

In conclusion, tariffs have a significant impact on the US stock market. While they can protect domestic industries, they also pose risks to market stability and investor confidence. As trade tensions persist, investors and businesses must remain vigilant and adapt to the evolving landscape.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....