In the vast landscape of the airline industry, US Airways stands out as a prominent player, offering investors a chance to tap into a market that's constantly evolving. With the stock symbol LCC, US Airways has become a key asset for those looking to diversify their portfolios. This article delves into the intricacies of US Airways stock, providing investors with essential insights and analysis.

Understanding US Airways Stock

US Airways, now a part of American Airlines Group Inc., has a rich history of growth and innovation. Its stock, traded under the symbol LCC, has seen its fair share of ups and downs. Understanding the nuances of this stock requires a look into the airline's financial performance, industry trends, and the broader economic landscape.

Financial Performance

One of the primary indicators of a company's health is its financial performance. Over the years, US Airways has shown consistent growth in revenue and profitability. Key metrics such as revenue per available seat mile (RASM) and passenger load factor (PLF) have been steadily improving, reflecting the airline's ability to optimize operations and increase profitability.

Industry Trends

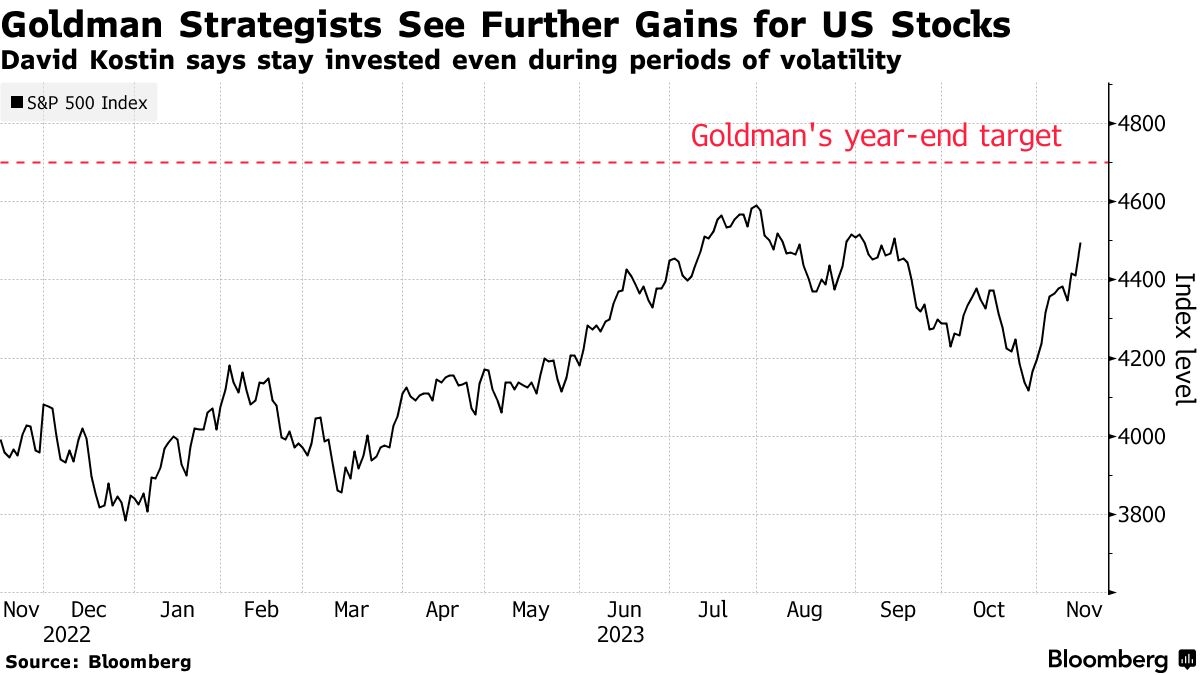

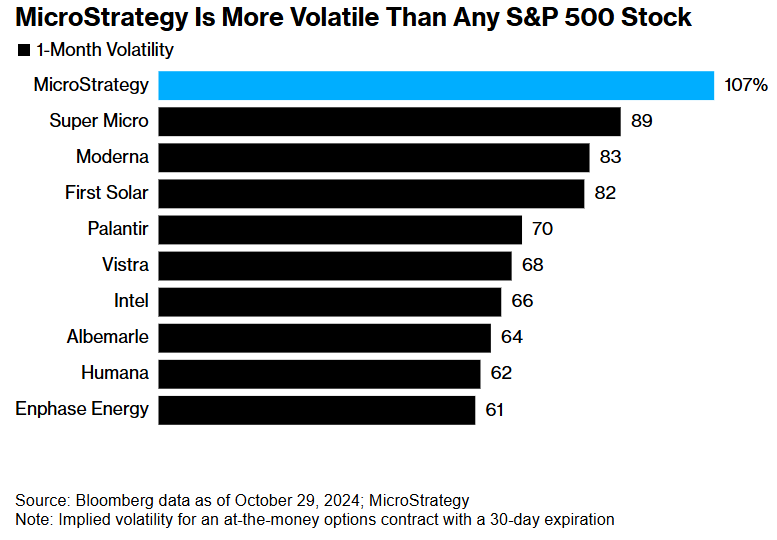

The airline industry is highly cyclical and sensitive to economic fluctuations. Factors like fuel prices, consumer confidence, and global events can significantly impact the industry. It's crucial for investors to stay informed about these trends to make well-informed decisions regarding US Airways stock.

Economic Landscape

The broader economic landscape plays a vital role in the performance of airline stocks. For instance, during the COVID-19 pandemic, the airline industry faced unprecedented challenges. However, with the rollout of vaccines and the easing of travel restrictions, the industry is expected to bounce back. This positive outlook can be seen in the recovery of US Airways' stock.

Dividend Yield

Another important aspect to consider when investing in US Airways stock is the dividend yield. As of the latest reports, the dividend yield has been steadily increasing, making it an attractive option for income-seeking investors.

Case Studies

To provide a clearer picture, let's look at a few case studies. During the financial crisis of 2008, US Airways faced significant challenges. However, the airline managed to navigate through the tough times by implementing cost-cutting measures and strategic partnerships. This resilience played a crucial role in the stock's recovery.

Similarly, during the COVID-19 pandemic, US Airways, along with American Airlines, implemented various measures to mitigate the impact of the pandemic. These included workforce reductions, fleet optimizations, and cost-saving initiatives. The stock's performance during this period reflected the airline's ability to adapt to the changing landscape.

Conclusion

In conclusion, US Airways stock (LCC) offers investors a unique opportunity to invest in a stable and growing industry. With a strong financial performance, positive industry trends, and a promising economic outlook, US Airways stock is a compelling investment option. As always, it's important for investors to conduct thorough research and consult with financial advisors before making any investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....