In the dynamic world of financial markets, the Bloomberg share price stands as a critical indicator of the company's performance and market sentiment. This article delves into the factors influencing the Bloomberg share price, recent trends, and what investors should consider when analyzing this crucial metric.

Understanding Bloomberg Share Price Dynamics

The Bloomberg share price, also known as the ticker symbol "BBGY," reflects the current market value of Bloomberg L.P., a global leader in business and financial information. The share price is influenced by a variety of factors, including the company's financial performance, industry trends, and economic indicators.

Financial Performance

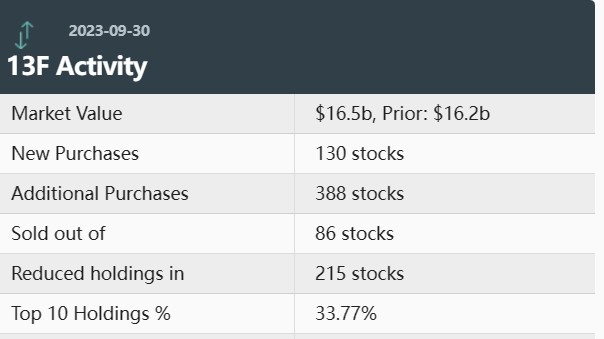

Bloomberg's financial performance is a key driver of its share price. Revenue growth, profit margins, and dividend yields are among the key financial metrics investors scrutinize. For instance, Bloomberg's revenue has consistently grown over the years, driven by its strong subscription model and expansion into new markets. This growth has contributed to a stable and increasing share price.

Industry Trends

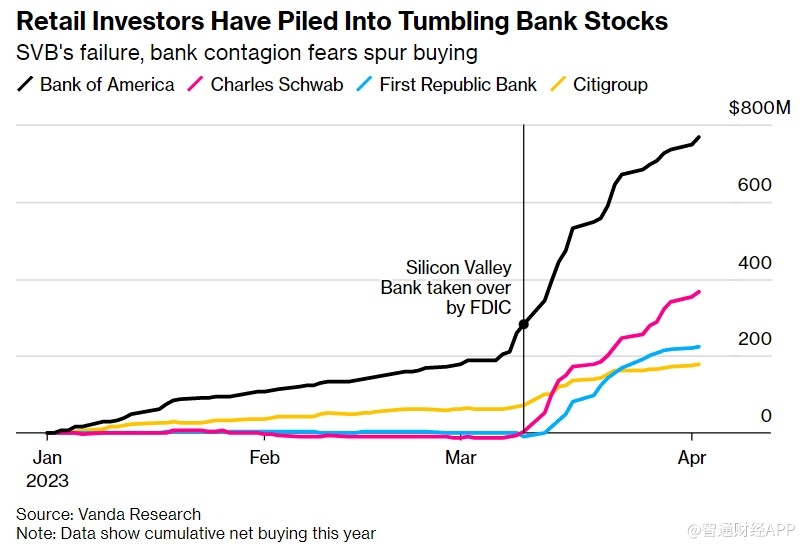

The financial information industry is highly competitive, with players like Reuters, S&P Global, and IHS Markit vying for market share. Industry trends, such as increased demand for real-time data and analytics, can significantly impact Bloomberg's share price. For example, the rise of fintech has created new opportunities for Bloomberg to expand its offerings and strengthen its market position.

Economic Indicators

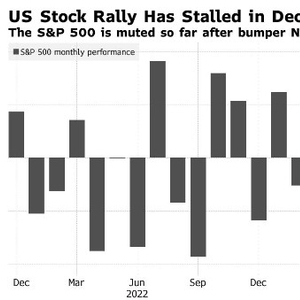

Economic indicators, such as interest rates, inflation, and GDP growth, also play a crucial role in determining the Bloomberg share price. These indicators can influence the overall market sentiment and, consequently, the share price of individual companies. During periods of economic uncertainty, the share price may experience volatility due to investor concerns.

Recent Trends

In recent years, the Bloomberg share price has exhibited a steady upward trend, reflecting the company's strong financial performance and market position. This trend can be attributed to several factors:

- Expansion into New Markets: Bloomberg has successfully expanded its operations into emerging markets, tapping into new customer segments and revenue streams.

- Product Innovation: The company has continually innovated its products and services, offering advanced analytics and data solutions to its clients.

- Strong Brand Reputation: Bloomberg's strong brand reputation and reputation for quality have helped it maintain a loyal customer base.

Case Study: The Impact of Economic Indicators on Bloomberg Share Price

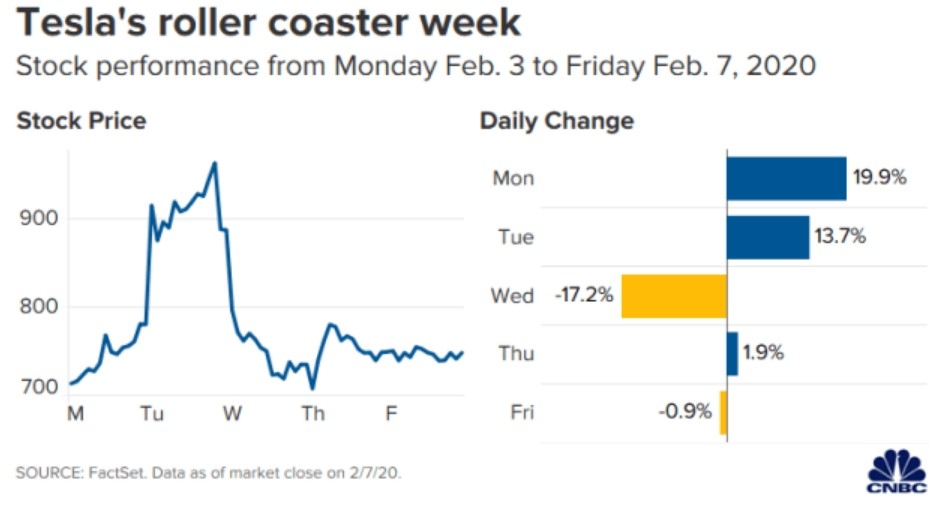

Consider the 2020 COVID-19 pandemic, which had a significant impact on the global economy and financial markets. During this period, the Bloomberg share price experienced volatility as investors reacted to the economic uncertainty. However, the company's strong financial performance and diversified revenue streams helped mitigate the impact of the pandemic, resulting in a gradual recovery in the share price.

Conclusion

The Bloomberg share price is a crucial metric for investors seeking insights into the company's performance and market sentiment. By analyzing factors such as financial performance, industry trends, and economic indicators, investors can make informed decisions about their investments in Bloomberg L.P.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....