Introduction:

In the United States, the stock market and the economy are closely intertwined, playing a pivotal role in shaping the country's financial landscape. This article delves into the relationship between the stock market and the economy in the US, highlighting key factors and providing insights into the current state of affairs. Let's take a closer look.

The Stock Market's Influence on the Economy:

The stock market serves as a barometer of the economy, reflecting the overall health and performance of businesses. When the stock market is performing well, it indicates a positive outlook for the economy. Conversely, a struggling stock market often signals economic challenges.

Stock Market Performance and Economic Growth:

One of the most significant correlations between the stock market and the economy is the relationship between stock market performance and economic growth. When the stock market is booming, it typically translates to increased consumer confidence, higher business investments, and, ultimately, economic expansion.

For instance, the tech sector has been a major driver of the US stock market's growth in recent years. Companies like Apple, Amazon, and Google have seen substantial stock price increases, reflecting their success and contribution to the economy.

Market Volatility and Economic Stability:

Market volatility can have a significant impact on the economy. While some level of volatility is natural, excessive volatility can lead to uncertainty and instability. This uncertainty can discourage businesses from investing, leading to slower economic growth.

During the 2008 financial crisis, the stock market plummeted, causing widespread panic and economic turmoil. The crisis served as a stark reminder of how interconnected the stock market and the economy are.

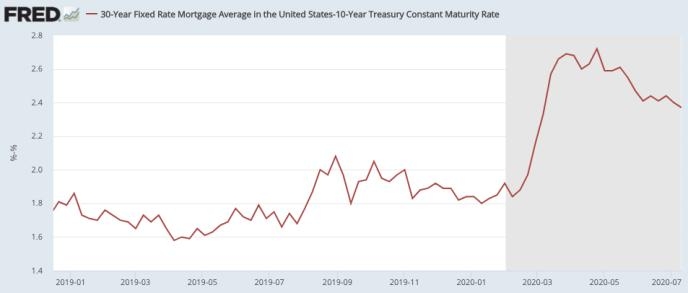

Interest Rates and the Stock Market:

Interest rates play a crucial role in influencing the stock market and, by extension, the economy. When interest rates are low, borrowing costs decrease, making it more affordable for businesses and consumers to invest. This often leads to a rise in stock prices and economic growth.

Conversely, when interest rates are high, borrowing costs increase, potentially leading to lower stock prices and slower economic growth. The Federal Reserve, which sets interest rates in the US, closely monitors economic indicators and adjusts interest rates accordingly.

Case Study: The Dot-Com Bubble

One notable example of the stock market's influence on the economy is the dot-com bubble of the late 1990s. During this period, internet stocks experienced exponential growth, leading to a frenzy of investment and speculation. However, this bubble eventually burst, causing significant financial losses and contributing to the 2001 recession.

The dot-com bubble serves as a reminder of the importance of monitoring stock market trends and ensuring they align with economic fundamentals.

Conclusion:

The stock market and the economy in the US are inextricably linked, with the stock market often serving as a bellwether for economic health. Understanding the relationship between these two elements is crucial for investors, businesses, and policymakers alike. By monitoring key factors such as stock market performance, market volatility, and interest rates, we can gain valuable insights into the current state of the economy and anticipate future trends.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....