The total capitalization of the US stock market is a vital indicator of the economic health and growth potential of the nation. It represents the total market value of all publicly-traded companies listed on US exchanges. In this article, we delve into the importance of this figure, its components, and its impact on the global economy.

The Significance of Total Market Capitalization

The total market capitalization of the US stock market is a reflection of the overall economic power and growth potential of the nation. It provides insights into the valuation of stocks, the health of the corporate sector, and the attractiveness of the US market to both domestic and international investors.

Components of Total Market Capitalization

The total market capitalization is calculated by adding up the market values of all publicly-traded companies on the US stock exchanges. This includes the major indices such as the S&P 500, the NASDAQ Composite, and the DJIA.

- S&P 500: This index includes the 500 largest companies listed on US exchanges. It serves as a benchmark for the performance of the US stock market.

- NASDAQ Composite: This index covers all companies listed on the NASDAQ exchange, which is known for its technology and biotech stocks.

- DJIA (Dow Jones Industrial Average): This index includes 30 large companies from various sectors of the economy.

Impact on the Global Economy

The total capitalization of the US stock market has a significant impact on the global economy. Here’s how:

- Investor Confidence: A high total market capitalization can indicate strong investor confidence in the US economy. This can lead to increased investment, both domestically and internationally.

- Interest Rates: The total market capitalization can influence interest rates. When the market capitalization is high, it can lead to higher borrowing costs for companies, as they may need to pay more to access capital.

- Currency Value: A strong US stock market can strengthen the US dollar, making exports more expensive and imports cheaper.

Historical Context

Over the years, the total capitalization of the US stock market has experienced significant fluctuations. Here are some key points:

- 2000 Tech Bubble: The total market capitalization reached its peak in 2000, driven by the tech bubble. However, this bubble burst, leading to a sharp decline in the market.

- 2008 Financial Crisis: The total market capitalization took a major hit during the financial crisis of 2008. However, it recovered rapidly in the years that followed.

- 2020 Pandemic: The pandemic caused another significant downturn in the market. However, the total market capitalization quickly recovered, driven by strong investor sentiment.

Case Studies

Several case studies highlight the importance of the total market capitalization:

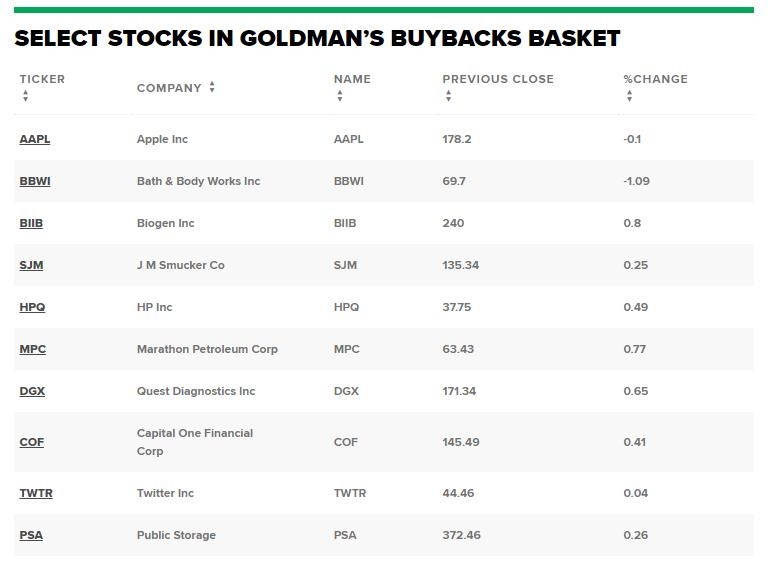

- Apple: Apple Inc., the world's most valuable company, has played a significant role in driving the total market capitalization of the US stock market.

- Amazon: Amazon.com Inc. has been another key driver of the total market capitalization, particularly in the technology sector.

Conclusion

The total capitalization of the US stock market is a critical indicator of the nation’s economic health and growth potential. By understanding its components and impact, investors and policymakers can gain valuable insights into the US and global economies. As the market continues to evolve, keeping a close eye on this figure is crucial for making informed decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....