Are you ready to dive into the world of stock options? If you're an investor looking to expand your portfolio, understanding stock options is crucial. E*TRADE, a leading online broker, offers a wealth of knowledge to help you grasp the basics and advanced concepts of stock options. In this comprehensive guide, we will explore the key aspects of stock options, their benefits, and how you can utilize them effectively.

What are Stock Options?

To begin with, let's define what stock options are. Stock options are a type of financial derivative that gives the holder the right, but not the obligation, to buy or sell shares of a company at a predetermined price (strike price) within a specific time frame (expiration date). There are two main types of stock options: call options and put options.

Call Options: A call option gives the holder the right to buy shares of a stock at the strike price. This is beneficial when an investor expects the stock price to increase in the future.

Put Options: A put option gives the holder the right to sell shares of a stock at the strike price. This is beneficial when an investor expects the stock price to decrease in the future.

Benefits of Stock Options

Now that we understand what stock options are, let's explore the benefits they offer to investors:

Leverage: Stock options allow investors to control a larger number of shares with a smaller amount of capital. This is because options provide leverage, allowing investors to gain exposure to the stock market without needing to purchase the entire stock.

Risk Management: Options can be used as a hedging strategy to protect your portfolio against market downturns. For example, if you own a stock that you're concerned about, you can purchase a put option to offset potential losses.

Profit Potential: While options can be risky, they also offer the potential for high returns. The more the stock price moves in the right direction, the greater the potential profit.

Understanding Stock Options at E*TRADE

E*TRADE is a valuable resource for investors looking to learn more about stock options. Their comprehensive educational resources cover various aspects of options trading, including:

Basic Options Concepts: Learn the fundamentals of stock options, such as strike prices, expiration dates, and the difference between call and put options.

Advanced Strategies: Explore advanced options strategies, such as covered calls, collar strategies, and vertical spreads.

Case Studies: Real-life examples of successful and unsuccessful options trades, demonstrating the potential risks and rewards of different strategies.

Case Study: The Covered Call Strategy

One popular options strategy is the covered call. Let's take a look at a real-life example to illustrate how this strategy works.

Suppose you own 100 shares of Company A, which you believe will increase in value over time. You can sell a call option on those shares, locking in a profit if the stock price rises. If the stock price increases and the call option is exercised, you will still own the shares and benefit from the higher stock price. However, if the stock price falls, you may be forced to sell your shares at the lower strike price, resulting in a potential loss.

This case study demonstrates the potential benefits and risks of the covered call strategy, highlighting the importance of understanding the ins and outs of stock options before implementing any strategy.

In conclusion, understanding stock options is essential for investors looking to expand their portfolio and potentially increase their returns. E*TRADE provides an extensive range of resources to help you learn about stock options, from basic concepts to advanced strategies. By leveraging these resources, you can make informed decisions and make the most of the opportunities that stock options offer.

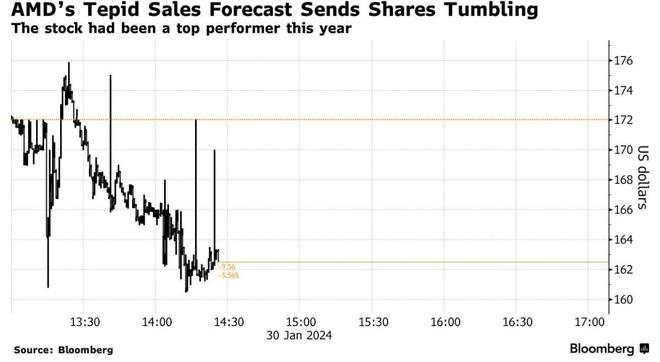

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....