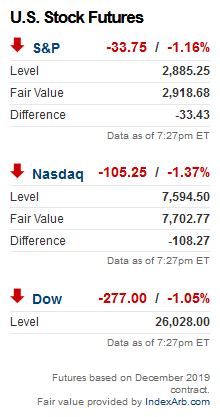

The SandP 500 Price is a term that has caught the attention of investors and financial enthusiasts alike. It represents the index of the 500 largest companies listed on the stock exchanges in the United States. This article aims to demystify the concept of the SandP 500 Price, its significance, and how it can be a valuable tool for investors.

What is the SandP 500?

The SandP 500 (Standard & Poor's 500) is a widely followed stock market index that captures the performance of the largest companies in the United States. It is considered a benchmark for the broader market and is often used as a proxy for the U.S. stock market's overall health.

Why is the SandP 500 Price Important?

The SandP 500 Price is a key indicator of the market's performance because it includes a diverse range of industries and company sizes. This makes it a comprehensive representation of the U.S. stock market. Investors and financial analysts closely monitor the SandP 500 Price to gauge market trends and make informed decisions.

Factors Affecting the SandP 500 Price

Several factors can influence the SandP 500 Price, including:

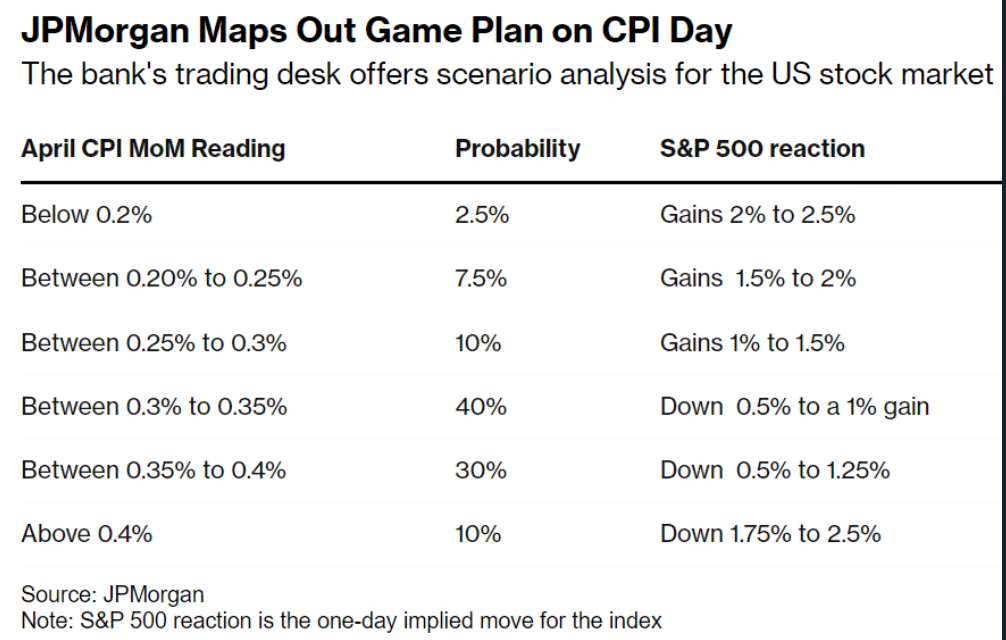

- Economic Indicators: Data such as GDP, unemployment rates, and inflation can impact the SandP 500 Price.

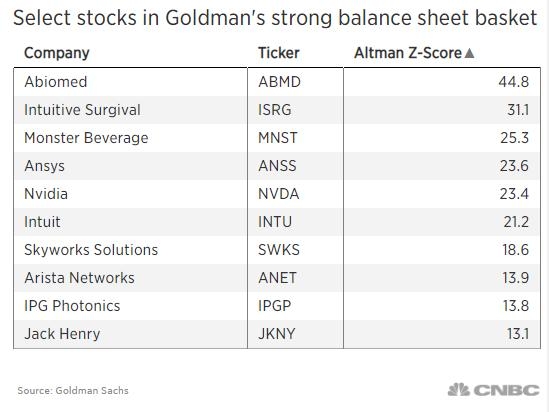

- Corporate Earnings: The financial performance of the companies in the index can significantly affect its price.

- Market Sentiment: Investor confidence and sentiment can lead to volatility in the SandP 500 Price.

- Global Events: Economic crises, political events, and other global occurrences can have a ripple effect on the SandP 500 Price.

How to Analyze the SandP 500 Price

To effectively analyze the SandP 500 Price, investors can use various tools and techniques:

- Technical Analysis: This involves studying historical price data and using various charts and indicators to predict future price movements.

- Fundamental Analysis: This involves analyzing the financial health and performance of the companies in the SandP 500 to determine their intrinsic value.

- Sentiment Analysis: Keeping an eye on investor sentiment can provide insights into market trends.

Case Study: The Impact of the Pandemic on the SandP 500 Price

The COVID-19 pandemic in 2020 was a significant event that impacted the SandP 500 Price. Initially, the index experienced a sharp decline as the pandemic spread and fears of economic downturns grew. However, as vaccines were developed and economies began to recover, the SandP 500 Price recovered and even reached new highs.

Conclusion

Understanding the SandP 500 Price is crucial for investors who want to stay ahead of market trends. By analyzing the various factors that influence the SandP 500 Price and using appropriate analytical tools, investors can make more informed decisions. Whether you're a seasoned investor or just starting out, the SandP 500 Price is a valuable indicator worth keeping an eye on.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....