In today's fast-paced financial world, keeping track of stock prices is crucial for investors. One stock that has been attracting significant attention is MRK, the ticker symbol for Merck & Co., Inc.. This article delves into the factors influencing the MRK US stock price, providing investors with valuable insights and a clear understanding of the market dynamics at play.

What is MRK Stock?

Merck & Co., Inc. is a global healthcare leader with a diverse portfolio of prescription medicines, vaccines, and animal health products. The company operates in various segments, including pharmaceuticals, vaccines, and animal health. With a strong presence in both the US and international markets, MRK has been a popular choice among investors seeking exposure to the healthcare sector.

Factors Influencing the MRK US Stock Price

Several factors can influence the MRK US stock price. Understanding these factors is crucial for making informed investment decisions. Here are some of the key drivers:

1. Earnings Reports:

One of the most significant factors affecting the MRK US stock price is its earnings reports. These reports provide insights into the company's financial performance, including revenue, profits, and growth prospects. Consistent earnings growth often leads to a higher stock price, while disappointing results can cause the stock to decline.

2. Pipeline of New Products:

Merck's pipeline of new products is another crucial factor impacting the stock price. The company is known for its commitment to research and development, consistently bringing innovative drugs and vaccines to market. Positive news regarding new product approvals or breakthroughs can significantly boost the stock price.

3. Regulatory Changes:

Regulatory changes in the pharmaceutical industry can have a significant impact on the MRK US stock price. For instance, changes in drug approval processes or pricing regulations can affect the company's revenue and profitability.

4. Market Sentiment:

Market sentiment also plays a crucial role in the MRK US stock price. Factors such as geopolitical events, economic indicators, and industry trends can influence investor confidence and drive stock prices.

5. Competition:

Competition in the pharmaceutical industry is fierce. Increased competition from generics or biosimilars can put pressure on MRK's pricing and market share, potentially affecting its stock price.

Case Study: MRK Stock Price Volatility

In 2019, MRK experienced significant volatility in its stock price, primarily due to its earnings reports. During the first quarter, the company reported disappointing earnings, leading to a decline in its stock price. However, after announcing new product approvals and strategic partnerships, the stock price recovered and ended the year with positive gains.

Investing in MRK Stock

Investing in MRK stock requires careful consideration of the factors mentioned above. It is crucial to stay informed about the company's financial performance, pipeline of new products, and market dynamics. Additionally, investors should consider their risk tolerance and investment objectives before making investment decisions.

Conclusion

Understanding the MRK US stock price involves analyzing various factors such as earnings reports, pipeline of new products, regulatory changes, market sentiment, and competition. By staying informed and making informed investment decisions, investors can navigate the complexities of the stock market and potentially achieve their financial goals.

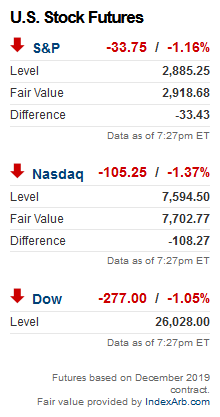

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....