Understanding the Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA) is one of the most widely followed stock market indices in the world. It represents the performance of 30 large, publicly-owned companies in the United States. By analyzing the DJIA's one-year graph, investors can gain valuable insights into the market's trends and potential investment opportunities.

One-Year Graph Overview

The one-year graph of the DJIA provides a visual representation of the index's performance over the past 12 months. This graph typically includes the following elements:

- Opening and Closing Prices: These are the prices at which the index opened and closed each trading day.

- High and Low Prices: These represent the highest and lowest prices reached by the DJIA during the trading day.

- Volume: This indicates the total number of shares traded during the day.

By examining these elements, investors can identify patterns, trends, and potential areas of concern.

Key Takeaways from the DJIA One-Year Graph

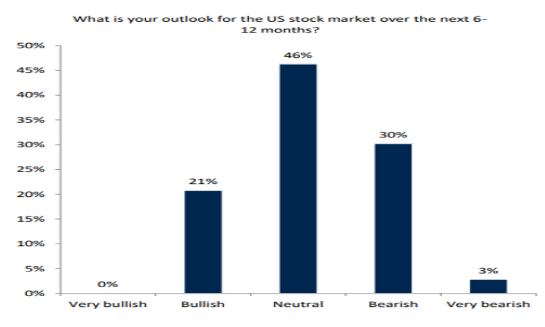

Trend Analysis: The DJIA's one-year graph allows investors to identify the overall trend of the index. Whether it's an upward trend (bull market), downward trend (bear market), or sideways trend (flat market), this information can help investors make informed decisions.

Support and Resistance Levels: These are price levels at which the DJIA tends to reverse its direction. By identifying these levels, investors can anticipate potential buying or selling opportunities.

Volume Analysis: High trading volume during a particular period can indicate strong interest in the market, which may lead to further price movements.

Economic Indicators: The DJIA's one-year graph can also be used to analyze the impact of economic indicators on the market. For example, a strong GDP growth may lead to an increase in the DJIA, while high unemployment rates may lead to a decline.

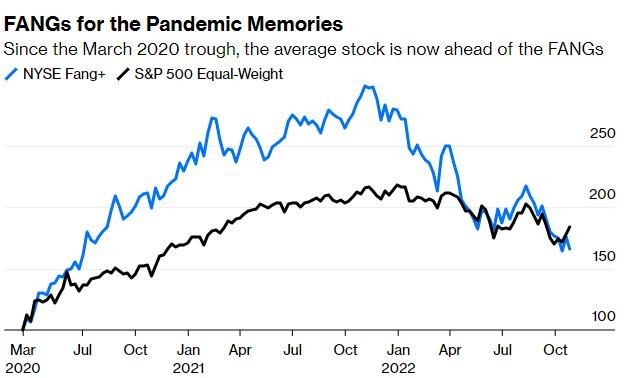

Case Study: The Impact of the COVID-19 Pandemic on the DJIA

In early 2020, the COVID-19 pandemic caused a significant drop in the DJIA. However, as the economy gradually recovered, the index began to rise again. This case study highlights the importance of analyzing the DJIA's one-year graph to understand the market's response to major events.

Tips for Interpreting the DJIA One-Year Graph

- Use Technical Analysis Tools: Tools such as moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels can help you identify potential trends and patterns.

- Stay Informed: Keep up with the latest economic news and events, as they can have a significant impact on the DJIA.

- Diversify Your Portfolio: While the DJIA can provide valuable insights, it's important to diversify your investments to mitigate risk.

In conclusion, the Dow Jones Industrial Average one-year graph is a powerful tool for investors looking to understand the market's trends and potential investment opportunities. By analyzing the graph and staying informed, investors can make more informed decisions and achieve their financial goals.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....